Unlocking Growth and Impact: Transformation Via Venture Capital Minority Investments and Buyouts

Venture capital, a powerful engine of innovation and economic growth, has traditionally focused on majority-owned investments in early-stage companies. However, a growing trend in venture capital is the use of minority investments and buyouts to support the growth and transformation of established businesses, particularly those owned by underrepresented groups.

Minority investments and buyouts offer several advantages over traditional majority-controlled investments:

- Increased Access to Capital: Minority investments and buyouts provide a non-dilutive source of capital for businesses, allowing them to access funding without giving up majority control.

- Strategic Expertise: Venture capitalists bring a wealth of operational, financial, and strategic expertise that can help businesses scale and achieve their full potential.

- Diversity and Inclusion: Minority investments and buyouts promote diversity and inclusion within the venture capital ecosystem, supporting businesses owned by entrepreneurs from underrepresented backgrounds.

- Economic Empowerment: By investing in minority-owned businesses, venture capitalists contribute to economic empowerment and wealth creation within underserved communities.

Established businesses, particularly those owned by underrepresented groups, often face unique challenges that can hinder their growth potential. These challenges include:

4.7 out of 5

| Language | : | English |

| File size | : | 16385 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 615 pages |

| Lending | : | Enabled |

| Hardcover | : | 116 pages |

| Reading age | : | 14 years and up |

| Item Weight | : | 12 ounces |

| Dimensions | : | 6.14 x 0.31 x 9.21 inches |

- Limited Access to Capital: Traditional lending institutions may be hesitant to provide financing to minority-owned businesses due to perceived risk factors.

- Lack of Business Networks: Minority entrepreneurs often lack access to business networks and mentorship opportunities that can provide vital support for their growth.

- Historical Underinvestment: Minority-owned businesses have historically received less venture capital funding than white-owned businesses, exacerbating systemic inequities.

Minority investments and buyouts address these challenges by providing access to capital, strategic guidance, and a network of support, enabling businesses to overcome obstacles and achieve transformative growth.

Numerous examples demonstrate the transformative power of minority investments and buyouts in practice:

Blackstone and Vista Equity Partners' Investment in Resource America: A minority investment by Blackstone and Vista Equity Partners provided Resource America, a leading provider of environmental services, with the capital and expertise it needed to expand its operations and enhance its technology platform.

KKR's Buyout of First Data: KKR's leveraged buyout of First Data, a global payments processor, unlocked significant value for the company by improving its operational efficiency, expanding its product offerings, and pursuing strategic acquisitions.

Vista Equity Partners' Minority Investment in Focus Financial Partners: Vista Equity Partners' minority investment in Focus Financial Partners, a provider of wealth management services, supported the company's growth and diversification efforts, enabling it to become a leading player in the industry.

These case studies highlight the potential of minority investments and buyouts to drive growth, innovation, and financial returns.

Transformation Via Venture Capital Minority Investments and Buyouts is a compelling read that provides valuable insights into the growing trend of minority investments and buyouts. This book is essential reading for venture capitalists, business owners, policymakers, and anyone interested in promoting growth, diversity, and economic empowerment through the power of venture capital.

By embracing minority investments and buyouts, venture capital can unlock the transformative potential of established businesses, particularly those owned by underrepresented groups. This can lead to increased economic growth, job creation, and a more equitable and inclusive society.

4.7 out of 5

| Language | : | English |

| File size | : | 16385 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 615 pages |

| Lending | : | Enabled |

| Hardcover | : | 116 pages |

| Reading age | : | 14 years and up |

| Item Weight | : | 12 ounces |

| Dimensions | : | 6.14 x 0.31 x 9.21 inches |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Nick Pendrell

Nick Pendrell Connor Grayson

Connor Grayson Jonathan King

Jonathan King Robert Maisel

Robert Maisel Slp Edition Kindle Edition

Slp Edition Kindle Edition Clarence Henry Haring

Clarence Henry Haring Philip Pomper

Philip Pomper Claire Kowalchik

Claire Kowalchik Craig Revel Horwood

Craig Revel Horwood Claudine Burnett

Claudine Burnett Elizabeth C Mckenna

Elizabeth C Mckenna Craig Leener

Craig Leener Sandra Clayton

Sandra Clayton Virginia A Greiman

Virginia A Greiman Clayton M Christensen

Clayton M Christensen Corrado Augias

Corrado Augias Colin Thomson

Colin Thomson Kenneth O Reilly

Kenneth O Reilly Jenifer Gamber

Jenifer Gamber Diane Daniel

Diane Daniel

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

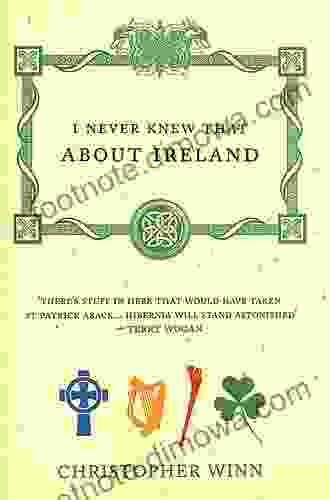

David MitchellUncover the Enigmatic Charm of the Irish: "Never Knew That About the Irish"

David MitchellUncover the Enigmatic Charm of the Irish: "Never Knew That About the Irish" Shawn ReedFollow ·19k

Shawn ReedFollow ·19k Donald WardFollow ·19.9k

Donald WardFollow ·19.9k Edward ReedFollow ·13.9k

Edward ReedFollow ·13.9k Octavio PazFollow ·10.7k

Octavio PazFollow ·10.7k Eli BlairFollow ·11.7k

Eli BlairFollow ·11.7k Chuck MitchellFollow ·10.1k

Chuck MitchellFollow ·10.1k Jared PowellFollow ·16.1k

Jared PowellFollow ·16.1k Dean ButlerFollow ·11.7k

Dean ButlerFollow ·11.7k

Howard Blair

Howard BlairThe Bewitching of Camille: A Mystical Tapestry of...

Prepare to be...

Kirk Hayes

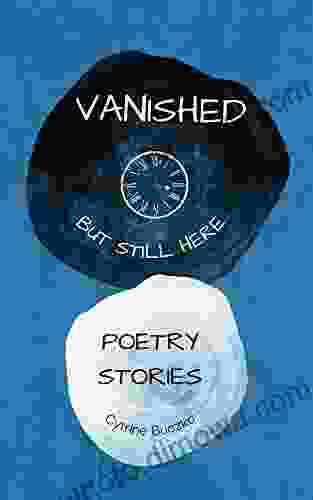

Kirk HayesUnraveling the Enigmatic Tale of "Vanished But Still...

In the labyrinth of memory...

Joe Simmons

Joe SimmonsDogwild: An Unforgettable Literary Odyssey into the Heart...

Delve into the Untamed...

Edgar Allan Poe

Edgar Allan PoeIndulge in Culinary Delights: Your Ultimate Costa Brava...

Discover the Flavors of Spain's Coastal...

4.7 out of 5

| Language | : | English |

| File size | : | 16385 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 615 pages |

| Lending | : | Enabled |

| Hardcover | : | 116 pages |

| Reading age | : | 14 years and up |

| Item Weight | : | 12 ounces |

| Dimensions | : | 6.14 x 0.31 x 9.21 inches |